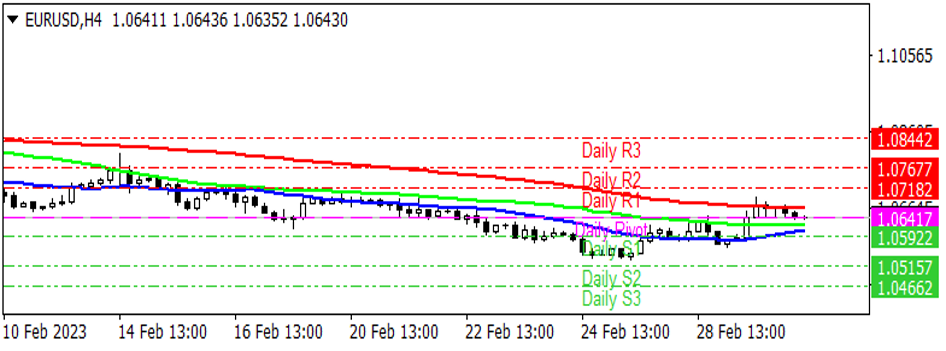

EURUSD

In Germany, the largest economy in Europe, inflation increased by 1 %on a monthly basis and 9.3 %on a monthly basis due to the increase in food prices for February. German Central Bank President J.Nagel said yesterday's statement that core price prints remain very strong and inflation would be in the range of 6 - 7 %this year, the interest rate hike in March will not be the last, and that there may be more increase if necessary. Manufacturing PMI in February 47.7 in the United States remained below the market expectations, while the manufacturing industry has continued in the 4th month in the 4th month. FED officials after the Sahin statements of the risk appetite continues to remain weak.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1,0844 |

| Resistance 2 | 1,0767 |

| Resistance 1 | 1,0718 |

| Support 1 | 1,0592 |

| Support 2 | 1,0515 |

| Support 3 | 1,0466 |

Daily Pivot Levels

GBPUSD

While the prices in the money markets on the European side continue to increase the risk perception, expectations that the European Central Bank (ECB) will continue to increase interest rates in 2024 continues to strengthen. On the other hand, the Central Bank of the UK (Boe) President Andrew Bailey said he would want to see the impact of the steps taken by the bank. The GBP/USD parity is priced at 1,1988 as of this morning.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1,2212 |

| Resistance 2 | 1,2150 |

| Resistance 1 | 1,2088 |

| Support 1 | 1,1964 |

| Support 2 | 1,1902 |

| Support 3 | 1,1840 |

Daily Pivot Levels

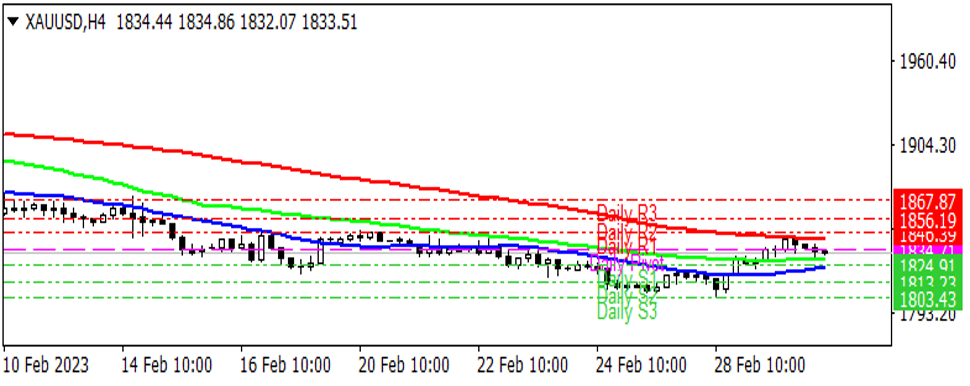

XAUUSD

Ones gold price is maintained in the price. In recent days, the expectations of the FED for gold showed the influence of the course of the dollar. The dollar index is traded between 104,38-104.61 this morning. Recently, it was seen that it was over 105. This suppressed the commodities. For this reason, the uncertainty and the course of the dollar in the markets until the Fed's meeting in March may cause weak commodities. Next week there will be employment in the United States and inflation week in the USA next week. In two important data, it may cause volatility in the course of ounce of gold. Today, secondary level data will be announced in the USA. The effect of these data on pricing may have limited.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1867 |

| Resistance 2 | 1856 |

| Resistance 1 | 1846 |

| Support 1 | 1824 |

| Support 2 | 1813 |

| Support 3 | 1803 |

Daily Pivot Levels

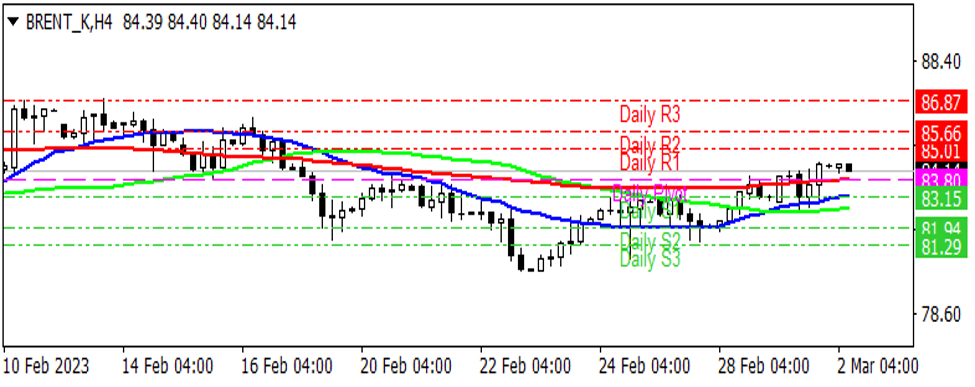

BRENT OIL

Oil prices are preserved cautiously. API and Doe weekly oil stocks announced this week also show an increase. The increase in stocks has a limited negative effect on oil prices. According to a comment on Goldman Sachs analysts, they say that the oil market will lose its backup capacity with the opening of China. They said that they expect oil to be traded over $ 100 per barrel in the 4Q period and believed that oil prices would increase in the 12-18-month period. Upward expectations for oil prices are still maintained. This allows the strong decline in prices to prevent it. Today, the course of the dollar can be followed.

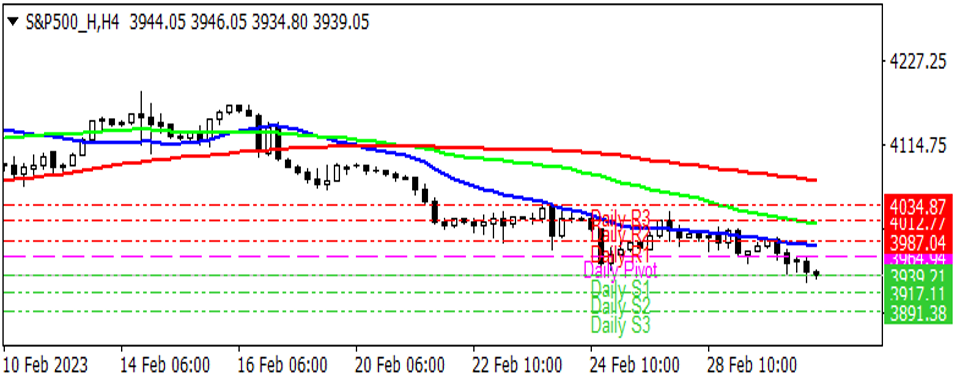

S&P500

With the recent ISM data and the statements of the FED members in the USA, higher peak Fed interest rates are priced in the markets. US stock markets showed a mixed look yesterday. While the rise in energy, raw materials and industrial sectors came to the forefront, there were decreases in public services, consumer services and telecommunications sectors. The Dow Jones index increased by 0.02% to the positive decomposition from other indices, while the S&P 500 index decreased by 0.47% and the NASDAQ index decreased by 0.66%. It can be said that the mixed appearance in the US matters has moved to the new day on the new day.