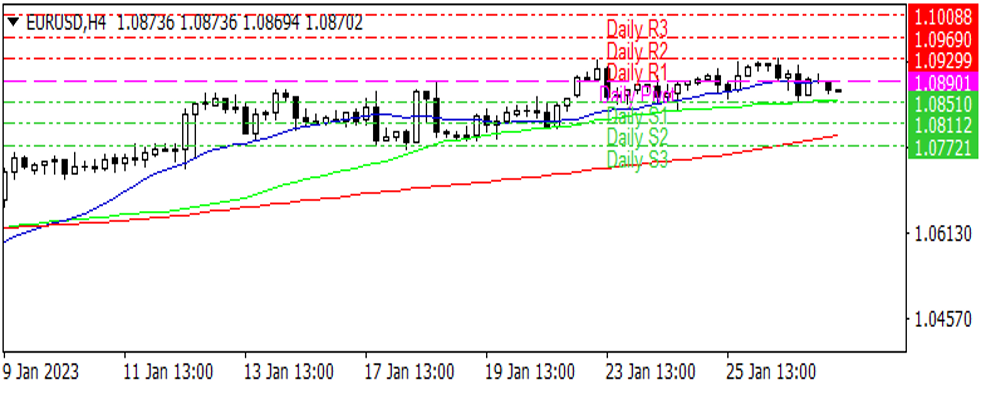

EURUSD

G. Makhlouf, Member of the European Central Bank and Governor of the Central Bank of Ireland, said that he supports the European Central Bank's increase in the next two meetings by an amount similar to the half-point rate hike last month. The US economy grew by 2.9% in the 4th quarter of 2022, more than expected. Personal consumption, which constitutes the largest part of the economy, increased by 2.1%, below the estimates. New home sales in the country continued to rise in the third month with the decline in housing loan rates. While the growth data, which exceeded the expectations, was effective in easing the concerns about the recession, a recovery was recorded in the dollar index.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1.1008 |

| Resistance 2 | 1.0969 |

| Resistance 1 | 1.0929 |

| Support 1 | 1.0851 |

| Support 2 | 1.0811 |

| Support 3 | 1.0772 |

Daily Pivot Levels

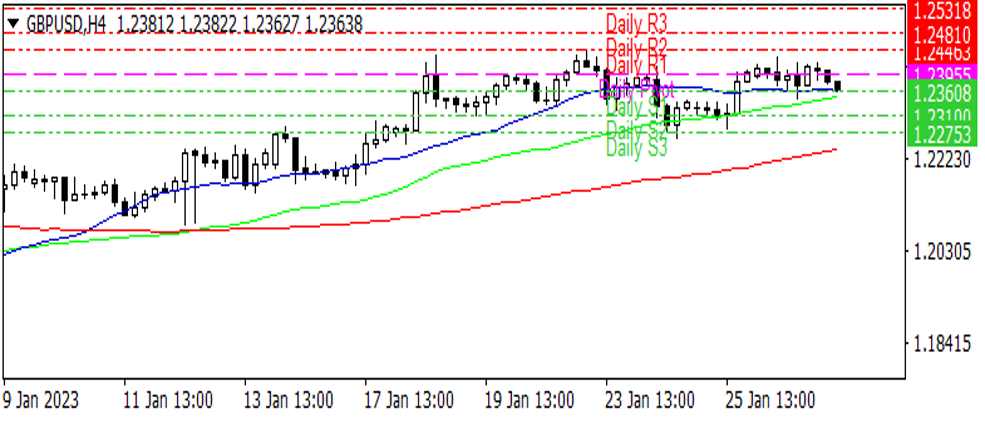

GBPUSD

The Bank of England (BOE) is expected to cut interest rates at the end of the year to support the economy. For the first time since August, the 25 basis point rate cut from the BOE is priced at 100 percent in the markets. Interest rate increases are expected to continue in the short term and interest rates are expected to peak at 4.5 percent until the summer months. This forecast came after data showing that inflation slowed in the country and economic growth stalled. The UK policy rate is now 3.5%, the highest in more than 10 years.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1.2531 |

| Resistance 2 | 1.2481 |

| Resistance 1 | 1.2446 |

| Support 1 | 1.2360 |

| Support 2 | 1.2310 |

| Support 3 | 1.2275 |

Daily Pivot Levels

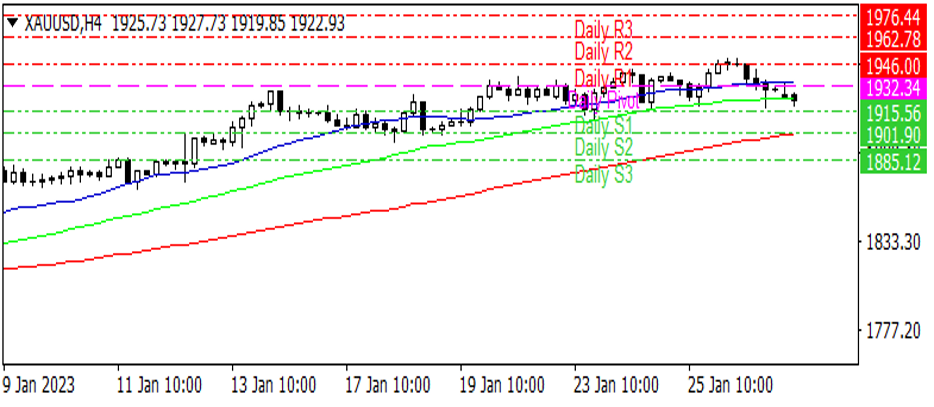

XAUUSD

The US economy grew by 2.9% in the fourth quarter. While the data came above the expectations, the previous data was realized at the level of 3.2%. Comments are made that the announced data has increased the soft landing expectations in the US economy and alleviated the recession concerns. After the data yesterday, positive trends were observed in the stock markets. The dollar index maintains its flat and loose course. The core personal consumption expenditures index, which is closely watched by the Fed, will be released today. Data-based movement can be seen. There's a Fed meeting next week. While the expectations about the Fed are reflected in the prices, it can be expected that the Fed uncertainty in the markets will increase as time gets shorter.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1976 |

| Resistance 2 | 1962 |

| Resistance 1 | 1946 |

| Support 2 | 1915 |

| Support 3 | 1901 |

| Support 1 | 1885 |

Daily Pivot Levels

BRENT OIL

Oil prices are trading with light buyers. The decrease in the number of fatal cases in China this week was positive for prices. While the risk appetite was fluctuating in global stock markets, the loose course of the dollar supported the continuation of the upward movement for oil. API and DOE weekly oil inventories announced this week saw increases and were interpreted as limited negative data for oil. Growth data was followed in the USA yesterday. Today, the core personal consumption expenditures index data, which is closely watched by the Fed, will be released. The course of the dollar, US data and the outlook for risk appetite can be followed in terms of oil prices.

S&P500

American stock markets closed positive on Thursday after US growth data gave signals for both soft landing and recession. S&P 500 closed the session yesterday at 4,060 with 1.10% gains. As of this morning, the S&P 500 December futures contract is viewed at 4,064.