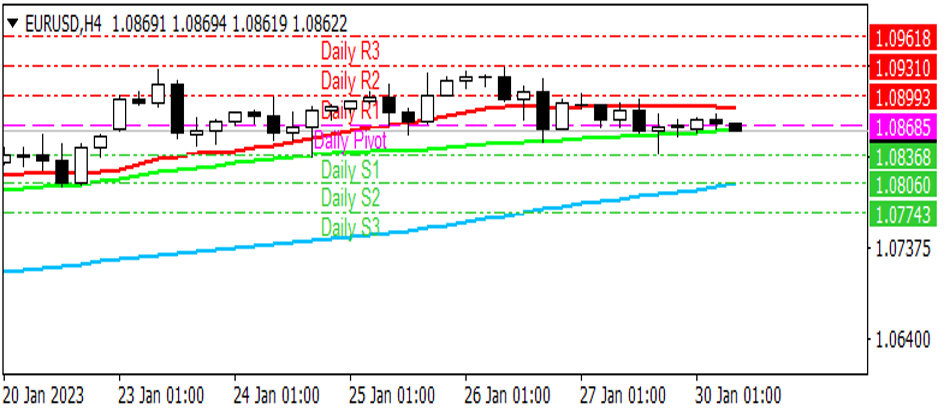

EURUSD

On the last trading day of the week, on the European front, ECB President C. Lagarde pointed to the meeting that will take place this week, giving signals that the attitude will continue. European Central Bank Executive Board Member F. Panetta reportedly said that the central bank should not make any prior commitments for any interest rate moves after its March meeting. Expectations at the bank's meeting this week are shaped for a 50 basis point rate hike. Pending house sales in the USA recorded the first increase since May 2022, after the sharp decline experienced last year due to high interest rates, and reached 76.9 with an increase of 2.5%.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1.0961 |

| Resistance 2 | 1.0931 |

| Resistance 1 | 1.0899 |

| Support 1 | 1.0836 |

| Support 2 | 1.0806 |

| Support 3 | 1.0774 |

Daily Pivot Levels

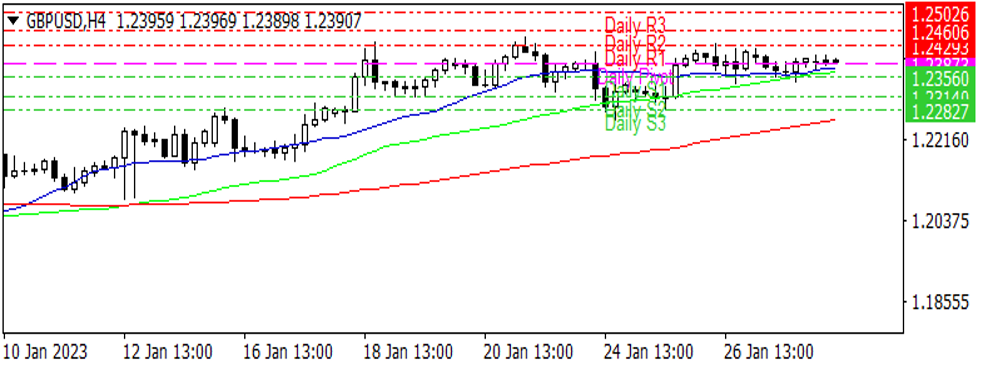

GBPUSD

The pessimism surrounding the British economy started to disappear, despite the signs that economic activity was decreasing. Confidence in the economy of the UK business world reached the highest level in 6 months. Confidence indicators are sending conflicting messages about the state of the economy, despite forecasters warning that the UK economy is on track to enter recession in the first half of 2023. The GBP/USD pair is priced at 1.2389 as of this morning.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1.2502 |

| Resistance 2 | 1.2460 |

| Resistance 1 | 1.2429 |

| Support 1 | 1.2356 |

| Support 2 | 1.2314 |

| Support 3 | 1.2282 |

Daily Pivot Levels

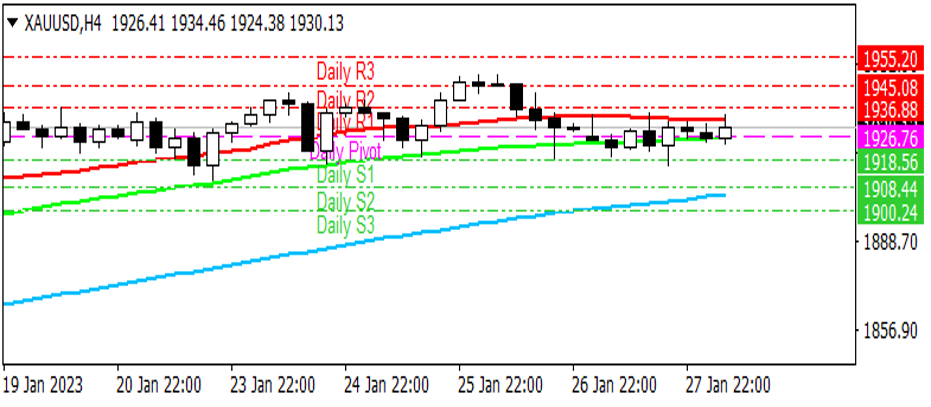

XAUUSD

While gold was rising towards the 1950$ limit, it was seen that it had difficulty in moving above this level. While there is a limited decrease, it is still limited in pullbacks. This week is an important week because interest rate decisions of major central banks will be followed. The US and European Central Banks have meetings this week and their decisions will be decisive in the course of the markets. There is no significant data flow to be announced for today. There will be meetings on Wednesday and Thursday, cautious movements in the markets can be observed beforehand. This morning the dollar index is trading between 101.79-102.03.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1955 |

| Resistance 2 | 1945 |

| Resistance 1 | 1936 |

| Support 2 | 1918 |

| Support 3 | 1908 |

| Support 1 | 1900 |

Daily Pivot Levels

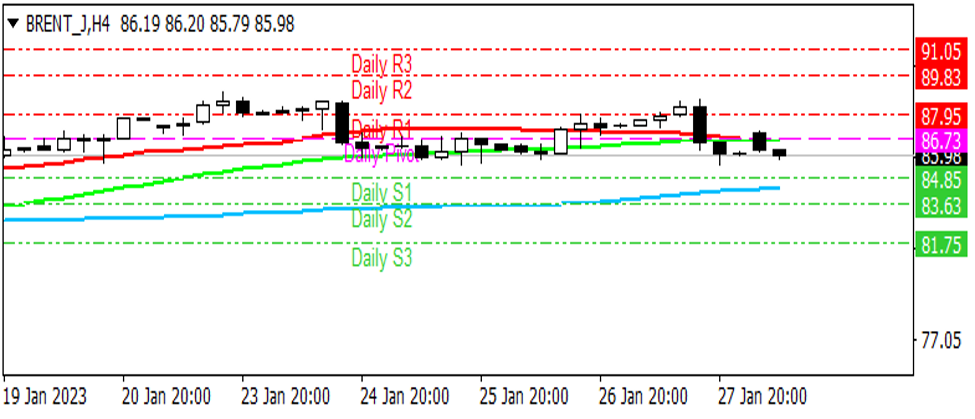

BRENT OIL

Oil prices started the new week with light sales. China was on holiday last week and their holidays are over. This week, China has returned and it is wondered how this return will reflect on the numbers. This week, the Chinese side will be watched closely. This week is seen as a critical week for central banks. The interest rate decisions of the Fed and the European Central Bank will be followed. It is stated that an advisory meeting of the OPEC+ group will be held within the week and the ministers are expected to meet. While no surprise decision is expected, it is a matter of curiosity how the ministers will evaluate the recent developments and what they will say about oil prices.

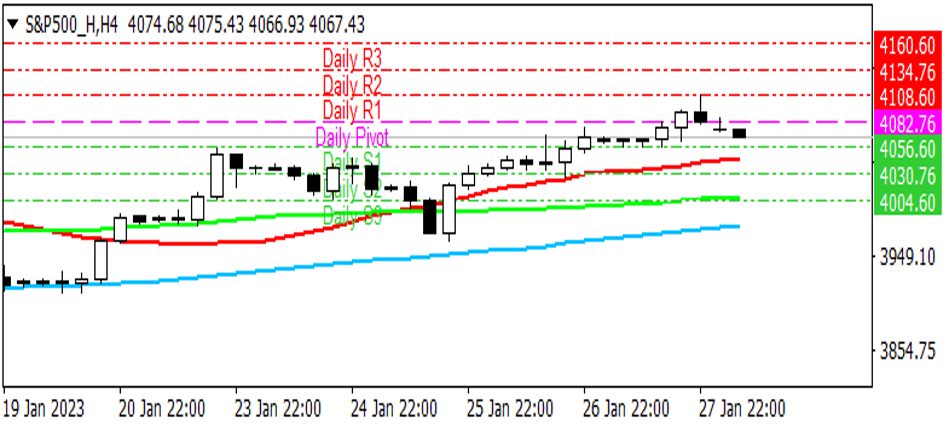

S&P500

U.S. stock markets rose on Friday, led by the consumer services and technology sectors. The S&P 500 index ended the day with 0.25% gain. It can be said that there is a negative outlook in US futures on the first trading day of the new week. The US employment report will also be on the agenda this week. Reports from Apple, Amazon, and Alphabet will arrive on Thursday. Meta Platforms, on the other hand, will announce its balance sheet on Wednesday.