EURUSD

While the German economy contracted by 0.2% in the last quarter due to the energy crisis and record inflation compared to the previous quarter, it grew by 0.5% on an annual basis. While recession concerns for Germany and Europe are rising, the German government said last week that it does not expect a recession by increasing its growth forecast for this year to 0.2%. The US Treasury Department raised its borrowing forecast for the first quarter of this year from $579 billion to $932 billion. While there is heavy data flow on the European front, conference board consumer confidence is expected to be announced in the USA today.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1.0971 |

| Resistance 2 | 1.0942 |

| Resistance 1 | 1.0896 |

| Support 1 | 1.0822 |

| Support 2 | 1.0793 |

| Support 3 | 1.0747 |

Daily Pivot Levels

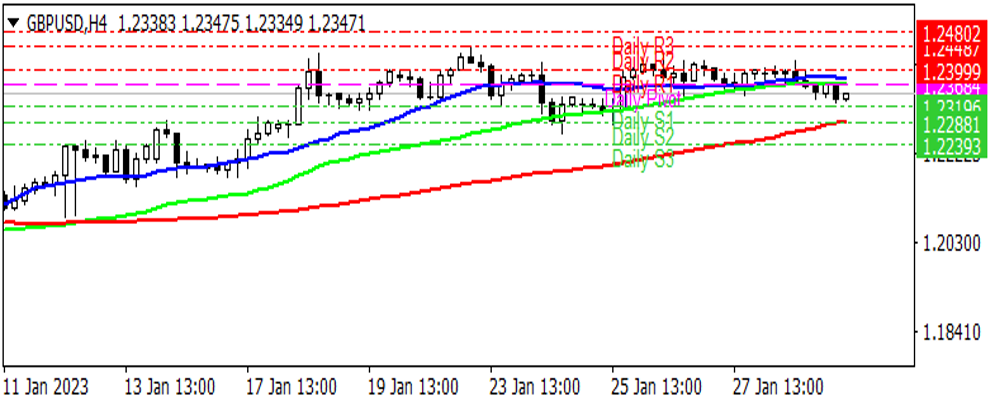

GBPUSD

British Finance Minister Jeremy Hunt stated that the epidemic revealed the weaknesses of the country's labor market. In his speech, Minister Hunt listed the government's goals under the heading "Our priorities, your priorities" as "halving inflation, growing the economy, reducing debt, shortening waiting times (in healthcare) and stopping illegal immigration". Referring to the country's chronic labor force crisis, Minister Hunt noted that the currently active workforce is 300,000 below the pre-epidemic level. Minister Hunt stated that about one-fifth of the total adult workforce is not actively involved in economic working life for various reasons.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1.2480 |

| Resistance 2 | 1.2448 |

| Resistance 1 | 1.2399 |

| Support 1 | 1.2319 |

| Support 2 | 1.2288 |

| Support 3 | 1.2239 |

Daily Pivot Levels

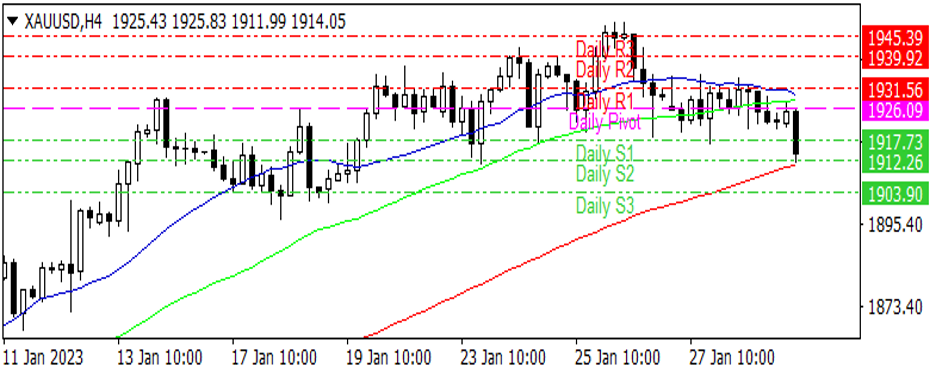

XAUUSD

The risk appetite in global markets is not very strong because the Fed's interest rate decisions are expected tomorrow and the European Central Bank's decision on Thursday. Before these two critical meetings, the markets are uneasy and cautious. The dollar index is hovering between 102.12-102.33 as of this morning. There are data to be announced in the USA today, but the impact may be limited. As the markets are waiting for the Fed meeting tomorrow, it can be expected that the cautious trend will continue in ounce. While the 25 basis points interest rate hike for the Fed tomorrow is certain, Fed Chairman Powell's speech and changes in the text of the decision will be followed by the markets.

Technical Analysis

| Support & Resistance | Level |

|---|---|

| Resistance 3 | 1945 |

| Resistance 2 | 1939 |

| Resistance 1 | 1931 |

| Support 1 | 1917 |

| Support 2 | 1912 |

| Support 3 | 1903 |

Daily Pivot Levels

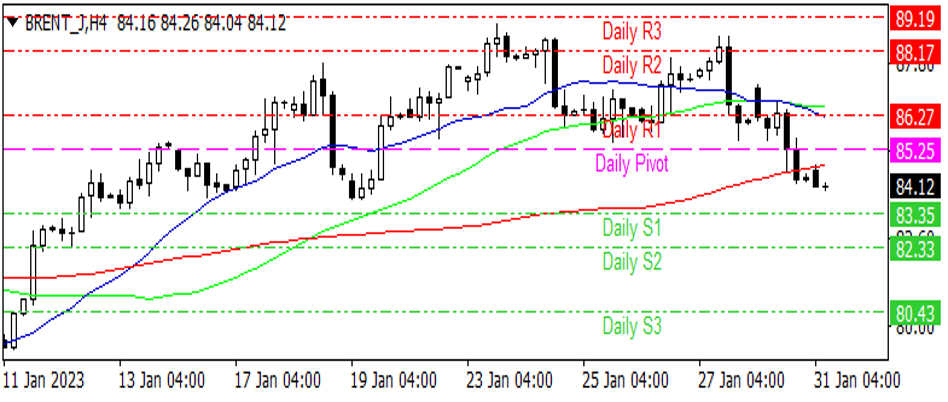

BRENT OIL

Oil prices are flat this morning. This week is a critical week because tomorrow the Fed and Thursday's interest rate decisions of the European Central Bank will be followed. Prior to these decisions, the risk appetite in global markets is not very strong and it is seen that cautious movements dominate. Although the European Union has applied a ceiling price to Russia since December, there are indications that Russia's exports have increased. This, in turn, causes oil prices to retreat, albeit to a limited extent. The OPEC+ joint ministerial monitoring committee meeting is expected tomorrow. At the same time, the Fed is expected to announce its decision tomorrow. Between these two topics, the Fed will be more important.

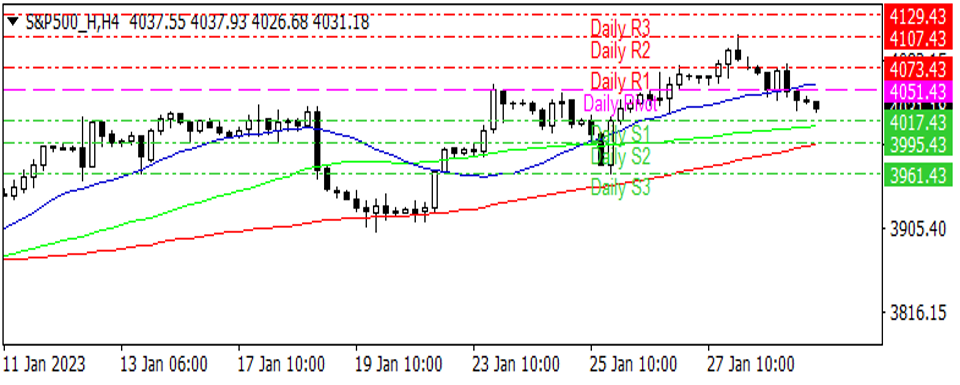

S&P500

Global stock markets are falling ahead of expected rate hikes by US and European central banks this week. With the Fed's interest rate decision to be announced this week, risk appetite decreased in Wall Street before the technology balance sheets including Alphabet and Meta, while Microsoft Corp., Apple Inc., Nvidia Corp. and Tesla Inc. The sales of the shares were effective. The S&P 500 closed the session yesterday, down 1.30% at 4.017. As of this morning, the S&P 500 December futures contract is viewed at 4.031 level.